1098-T Tax Information & W-9S Form

1098-T Tax Information & W-9S Form

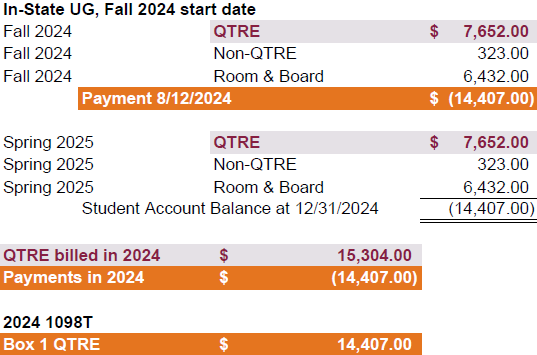

Note that all payments received during the tax year up to the total of qualified tuition and related expenses billed in the tax year will be reported in Box 1. The amount you are deemed to have paid in the tax year may not match Box 1. For example, payments made in August 2024 may be included on the 2024 1098-T as payments towards spring 2025 QTRE because these were billed to the student account in December. Qualified students may receive a detailed breakdown of form calculations by retrieving their 1098-T online through the Hokie Spa. Authorized parents may also access this information through the eBill portal. Please direct questions to your qualified tax preparer.

Below is a sample box 1 calculation:

1098-T Overview

Information on this site is not intended as legal or tax advice. Please refer with a personal tax advisor or the Internal Revenue Service to determine your eligibility for education tax credits.

The Taxpayer Relief Act (TRA) of 1997, created tax benefits for families or students who are paying for higher education or repaying student loans. Through Virginia Tech, students, or the persons who can claim them as dependent, may be able to claim an education credit on Form 1040 or 1040A, only for the qualified tuition and related expenses that were actually paid during a calendar year.

In Box 1, we will report payments related to qualified tuition and related expenses (QTRE) Virginia Tech billed to your student account for the calendar (tax) year. The amount shown may represent an amount other than what was actually paid. Payment for expenses that do not qualify will not be included in box 1. Examples include:

- Insurance

- Medical expenses (including the Health Fee)

- Room and board

- Similar personal, living, or family expenses

An electronic copy is available on Hokie Spa in mid-January of each year and provides the student detailed information on each amount reported.

Consent for electronic viewing is granted through confirmation of the Student Financial Responsibility and 1098-T Electronic Release. Students will receive an email notification in January alerting them that the 1098-T is available to view and print through Hokie SPA. The hardware and software requirements needed to access the 1098-T Tuition Statement electronically include an internet connection and web browser.

This consent will extend to future tax years while you are a student at Virginia Tech. Students may withdraw consent and opt for a paper form by contacting the Office of the University Bursar in writing at:

Office of the University Bursar (MC0143)

Student Services Building, Suite 150, Virginia Tech

800 Washington Street SW

Blacksburg, Virginia 24061

The withdrawal of consent for electronic form delivery will be in effect for one year from the date of receipt, at which time another request should be submitted to continue to receive a paper form.

The University encourages all students to receive their 1098-T form online through Hokie SPA. Students that have not granted consent to view the form online will receive it by standard mail. Please be aware that Virginia Tech is not responsible for forms lost or delayed in the mail. If a mailed 1098-T form is not received the student must obtain their form online through Hokie SPA.

Some student scenarios who will not receive a 1098-T:

- May graduates where Spring semester charges were applied and paid prior to the tax calendar year.

- Students who did not make a payment towards qualifying tuition and related expenses within in the calendar year.

- If academic credit hours were not achieved during the calendar year for which the 1098-T is produced.

Qualified students may receive a detailed breakdown of box 1 and 5 by retrieving their electronic form online through the eBill portal.

Authorized Payers have access to view or print the form through the Authorized Payer System. The student must grant this permission and establish access through their Hokie Spa. Access can be revoked by the student at any time.

To see if you qualify for the credit, or for help in calculating the amount of your credit, please see the following Internal Revenue Service websites.

- Internal Revenue Service

- 1098-T Form

- Tax Benefits for Education Information Center

- Publication 970, Tax Benefits for Education

- Education Credits Form 8863

- Tuition and Fees Deduction Form 8917

In addition, you may need to contact a personal tax advisor and the Internal Revenue Service at 800-829-1040 for more information or to determine if you are eligible for the tax credits.

International Students

Virginia Tech is not required by the IRS to file a Form 1098-T for non-resident aliens. These students are exempt because non-resident aliens are not eligible for education tax benefits unless they are residents for tax purposes. However, Virginia Tech cannot make a definitive determination which international students are residents for tax purposes. The IRS also requires Virginia Tech to provide a 1098-T to any non-resident alien who requests to receive one. Because we cannot determine who should and who should not receive the 1098-T, we generate a form for all students and request a Tax Identification number, even though the student may or may not be eligible for an education tax credit.

Contact Us

Phone: 540-231-2175

Email: bursar@vt.edu

VT Federal Identification Number: 546001805

Please include or have available your Family Educational Rights to Privacy Act password.

Frequently Asked Questions

Box 1 includes payments for tuition and the following fees received during the calendar year (January 1 - December 31): tuition, technology fee, library fee, commonwealth facility & equipment fee (non-resident only), student activity fee, athletic fee, recreational sports fee, and student services fee.

Please note that spring charges are typically billed in December when a student pre-registers. This means that payment for spring charges may fall onto the prior year 1098-T depending on when payment is received (example: Spring 2025 charges billed to the student in December 2024 where payment is received in December, will be included on the 2024 1098-T).

Virginia Tech does not bill for these types of items. Students must keep track of their qualified charges in their own records.

If you have further questions or need more assistance, please contact the IRS at www.irs.gov, or contact your personal tax advisor.

Virginia Tech is not required to issue a 1098-T to:

- Students who have no payments toward qualified tuition and related expenses in the calendar year (Box 1), have no new scholarships or grants (Box 5), and no adjustments to scholarships or grants (Box 6).

- Students covered by a formal billing arrangement between the institution and an employer or a government entity.

- Students classified as a Non-Resident Alien by the University Registrar, will not have a 1098-T form generated.

Please review all the information provided.

If you still believe there is an error on the 1098-T, please contact the Office of the University Bursar at 540-231-2175 or bursar@vt.edu.

The student will need to:

- Login to Hokie Spa

- Click on "View and Pay eBill"

- Click on "Tax Form"

- Click the icon next to the desired tax year

*only tax years 2023 and forward will be displayed here.

Virginia Tech is not required by the IRS to file a Form 1098-T for non-resident aliens. These students are exempt because non-resident aliens are not eligible for education tax benefits unless they are residents for tax purposes.

However, Virginia Tech cannot make a definitive determination which international students are residents for tax purposes.

The IRS also requires Virginia Tech to provide a 1098-T to any non-resident alien who requests to receive one. Because we cannot determine who should and who should not receive the 1098-T, we generate a form for all students and request a Tax Identification number, even though the student may or may not be eligible for an education tax credit.